The Union Budget 2023 brought some significant changes to the taxation of investments in Debt Mutual Funds (DMFs) in India. Earlier for Debt MFs held for over 3 years, investors were liable to be taxed at 20% with indexation benefits. Starting from 1-Apr-2023, incremental investments made in Debt Mutual Funds with less than 35% domestic equity holdings will be subject to taxation at the marginal tax rate. This means that the Long-Term Capital Gain (LTCG) taxation benefit with indexation that investors enjoyed earlier will be withdrawn. It also means that long-term capital gains on debt funds will now be taxed at the investor’s marginal tax rate, which can be significantly higher than the previous rate of 20%.1

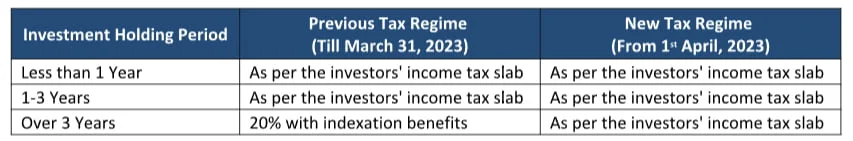

Here is a simple illustration of how the taxation will be:

Here is an illustration of how a 1,00,000 investment in a Debt Mutual Fund would be taxed post a 3-year investment period before and after the new tax regime:

Assumptions:

- Investment amount: ₹100,000

- Holding period: 3 years

- Annualized return: 7%

- Inflation rate for indexation: 4%

- Taxpayer’s income tax slab: 30%

Old Tax Regime (before April 1, 2023):

| Description | Calculation | Amount (₹) |

| Initial Investment | 100,000 | |

| Value after 3 years | 100,000 * (1 + 0.07)^3 | 122,504 |

| Indexed cost of acquisition** | 100,000 * (1 + 0.04)^3 | 112,486 |

| Long-term capital gain | 122,504 – 112,486 | 10,018 |

| LTCG Tax (20% with indexation) | 10,018 * 0.2 | 2,004 |

| Net returns after tax | 122,504 – 2,004 | 120,500 |

New Tax Regime (after April 1, 2023):

| Description | Calculation | Amount (₹) |

| Initial Investment | 100,000 | |

| Value after 3 years | 100,000 * (1 + 0.07)^3 | 122,504 |

| Capital gain | 122,504 – 100,000 | 22,504 |

| Capital Gains Tax (at highest slab rate of 30%) | 22,504 * 0.3 | 6,751 |

| Net returns after tax | 122,504 – 6,751 | 115,753 |

*Please note that the actual inflation rate used for indexation might be different, as it is based on the cost inflation index (CII) published by the Income Tax Department for each financial year. The CII is used to adjust the purchase cost of an asset to account for inflation during the holding period.

In the example, the 4% inflation rate was used as a simplification to demonstrate the concept of indexation. For more accurate calculations, you should refer to the relevant CII figures released by the Income Tax Department.

From the above example, you can see that the new tax regime results in a higher tax liability compared to the old tax regime, as indexation benefits are no longer available and capital gains are taxed at the taxpayer’s income tax slab rate.

Please note that this illustration is only for explanatory purposes and should not be considered as financial advice. The actual tax implications for your clients may differ depending on their individual circumstances, and it is always a good idea to consult a tax professional for personalized guidance.

Overall, while the new tax regime will result in a higher tax liability for investors in debt mutual funds, the benefits of indexation and higher possibility of returns compared to fixed deposits can still make them an attractive investment option for investors with a long-term investment horizon.

What does this mean for investors who have invested in DMFs?

While these changes in taxation may make investments in Debt MFs and other categories of mutual funds less attractive, it is essential to think about the larger picture before making any immediate changes. It is worth noting that tax benefits were not the sole reason we opt for Debt MFs. A well-diversified investment portfolio should have a multi-asset approach, and Debt MFs have advantages beyond the LTCG taxation benefit.

- One advantage of DMFs is that taxation only occurs when you withdraw the funds, unlike FDs, where the interest is taxed yearly.

- Secondly, the treatment of capital gains in DMFs is more favorable. When you redeem your investment, only a part of the income is subject to taxation, i.e., the growth component, and not the entire amount. This is different from FDs, where the entire interest earned is added to taxable income.

So, does this mean that bank fixed deposits are now a better investment option than debt mutual funds? Not necessarily. There are still several advantages to investing in Debt Mutual Funds that make them a better option for certain investors.

Firstly, debt funds offer better possibility of returns than fixed deposits over the long term. While fixed deposits may offer guaranteed returns, they often fail to keep up with inflation. In contrast, debt funds invest in a diversified portfolio of bonds and securities, which can provide higher possibility of returns than fixed deposits in the long run.

Secondly, debt funds offer greater flexibility than fixed deposits. Unlike fixed deposits, debt funds have no lock-in period, which means investors can redeem their investment at any time without incurring any penalty. Additionally, debt funds offer the option of a systematic investment plan (SIP), which allows investors to invest small amounts of money at regular intervals.

Thirdly, debt funds offer greater diversification than fixed deposits. While fixed deposits are typically offered by banks, debt funds are offered by asset management companies and can invest in a wide range of bonds and securities, including corporate bonds, government securities, and money market instruments. This allows investors to diversify their portfolio and minimize risk.

What should you do?

Holding on to existing Debt Funds can be beneficial as they are not affected by the new tax rules that were implemented from 1 April. Investors can also consider breaking fixed deposits instead of redeeming their debt and gold funds if they need to withdraw some amount from their fixed income portfolio for any upcoming expense. The longer investors hold their debt funds, the greater the indexation benefit they will fetch, and the lower the tax will be.

Debt funds are also very tax-efficient for systematic withdrawals, especially for retirees, as the tax is only levied in the year of redemption. Furthermore, debt funds offer flexibility to the investor as they can increase or decrease the frequency and quantum of investment anytime. Some categories of debt funds have the potential to deliver higher possibility of returns than fixed deposits, making them an attractive option for investors.

Fixed deposits offer an iron-clad assurance of returns and are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC) for deposits of up to Rs. 5 lakh per account holder per bank. However, fixed deposits with NBFCs are not covered by this insurance, and mutual funds cannot give any assurance of returns. It is crucial to invest in fixed deposits with care, as it is wise to split the investment into 2-3 investments across different banks and not put a large amount into one deposit. Building a ladder of fixed deposits with different tenures can also ensure liquidity as one deposit matures every year. This strategy can also prevent investors from having to break the entire deposit if they need to withdraw some amount. While fixed deposits offer security, they cannot be adjusted against any income, and interest rates on fixed deposits may not be as high as some categories of debt funds. Therefore, investors should carefully consider their investment goals and risk appetite before investing in fixed deposits.

Conclusion

In conclusion, the recent change in tax rules has made debt mutual funds less tax-efficient than fixed deposits. However, debt funds continue to offer several advantages over fixed deposits, better possibility of returns, greater flexibility, and greater diversification. Ultimately, the choice between debt funds and fixed deposits will depend on the investor’s financial goals, risk tolerance, and investment horizon.

Leave a Comment