Let this headline sink in.

Retail inflation in the nation, as determined by the Consumer Price Index (CPI), decreased from 6.77 percent in October to 5.88 percent, an 11-month low. Inflation in the food basket, as measured by the Consumer Food Price Index (CFPI), decreased month over month from 7.01% in October to 4.67% in November.

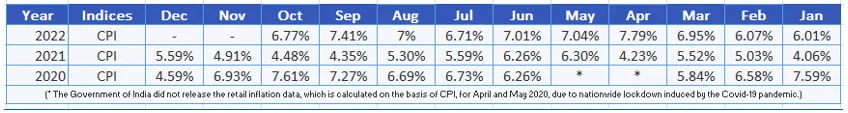

The central bank in India has mandates to keep retail inflation at 4% with a 2% tolerance on either side. Here is a quick look at the rate of inflation measured in CPI over the previous decade.

What is CPI?

The CPI calculates the value of the currency in a given economy also known as purchasing power of the currency. It also serves as a metric for measuring inflation. This is accomplished by tracking the shift in the prices of goods purchased by retail consumers, who represent the demand side of the economy. CPI monitors the rate of increase in the cost of a chosen basket of goods and services over a chosen time frame. It is depicted as a percentage that defines the increase or decrease in prices of goods and service in comparison to a specific base year.

The formula for calculating CPI index is:

(Cost of a fixed basket of goods and services in the current year/cost of a fixed basket of goods and services in the base year) * 100

” ]https://www.tbng.co.in/wp-content/uploads/2022/12/blog-weight.jpg

Items for the CPI basket of goods and services are classified across categories. Currently 299 categories of goods and services are taken into consideration for this calculation. Food and beverages category hold a significant share in the CPI basket. Any movement in this category has its effects on the rate of inflation. In November, prices for vegetables, oils and fats, sugar, and confectionary contracted aiding to a drop in CPI percentage and inflation as a whole.

What about core inflation?

Core inflation refers to price changes for goods and services excluding those from the food and energy sectors. Food and energy prices are not included in this calculation due to their potential for extreme volatility. Shaktikanta Das, governor of the RBI, claims that core inflation is still elevated and sticky, which is why the monetary policy committee (MPC) increased the repo rate by 35 basis points (bps) to 6.25 percent in December in order to combat inflation.

“The resurgence in domestic services sector activity could also lead to price increases, especially as firms pass on input costs”. – Shaktikanta Das, governor of the RBI

Investments and Inflation

If you have maintained the same lifestyle expenses for over the ast two years, you may have realised that compared to last years your finances seem to be a bit tighter this year. This is brought on by the sharp increase in prices of goods and services brought on by inflation. In order to prevent the long-term effects of inflation, it is time for you to review your investments and expenditure. Here are some ways to go about it.

Personal Inflation Rate – It is a straightforward calculation that divides current monthly expenses by monthly expenses from one year ago. Next, divide that difference by your previous year’s monthly spending. If your monthly expenses is Rs.50,000 today and the same was Rs.45,000 last year (assuming no major changes have occurred in lifestyle expenses) then the difference is Rs.5,000 which is a 11% increase over last years expenses. Knowing your personal inflation rate will help you put your spending into perspective and motivate you to cut any unnecessary expenses from your budget.

Remain Invested – Market volatility increases during periods of high inflation. You might start to question whether it’s time to cut back on your savings. This would entail leaving money on the table, which again depreciates with inflation. It is best to stay invested even in volatile markets, but you should be vigilant of your risk tolerance and consider your time horizon for each goal.

Cash in Hand – Depending on the investor’s risk tolerance, cash in hand should equal between three and twelve months’ worth of expenses. Since inflation is on the rise inflation-adjusted returns are likely to be higher. Make sure you have a reserve so you can meet your ongoing obligations without having to draw from investments that are meant to increase in value over time.

Additional income – Look for ways to increase your current sources of income and to supplement them. Building additional sources of income can help you stay on track with your current investments and expenses in an inflationary environment without having to make significant cuts. Additionally, it can aid in balancing any budgetary gaps brought on by higher prices.

The first step in anticipating inflation is to examine your fixed and discretionary spending to see where you can make savings. As inflation erodes purchasing power, you should reevaluate your priorities to ensure you are spending money on essentials. The next step is to evaluate your investments and rebalance your portfolio to achieve returns that beat inflation. Last but not least, staying invested is essential to fending off inflation’s long-term effects.

Leave a Comment