The significance of retirement planning is understood by almost everyone. However, it will be challenging to retire comfortably if you don’t make good financial plans. Nowadays, a lot more people avoid retirement planning instead of making plans for the future. Even though retirement planning is essential, many people often come up with justifications for not doing it. So, despite having a prosperous career, they pass away in poverty.

I’ve outlined four typical explanations in this article for why people frequently put off making future planning. Read on. If this describes how you think, it’s time to re-evaluate how you approach retirement planning and saving.

I’m struggling to keep up with my expenses.

This represents the initial barrier to saving in general. Investors frequently prioritize spending over saving, which results in a lack of funds at the end of each month to set aside for investing. Investing and saving must be prioritized. The fact that there is a struggle to make ends meet does not provide a sufficient justification for hiding. There needs to be action taken gradually. The last thing you would ever want in your golden years is to be dependent on others for your financial support.

It is easy to defer saving for retirement to the next month or the next salary hike or bonus. Saving is a habit that needs to be incorporated at an early stage, whether it is for retirement or children’s education. Finding an excuse to set this goal aside is the easiest thing to do.

Tip: Start with a tiny amount of Rs. 5,000/- each month, and automate the payment to an RD or a SIP. You can gradually increase the value as and when your expenses are curtailed.

Other goals are of top priority.

Looking out for yourself before your kids may be considered taboo in our culture. India is a much more conservative nation than the United States, where children must become self-sufficient and support themselves by the age of 18. This bond is fostered by Indian parents who dedicate their lives to guarding and supporting their children, even beyond adulthood. The money set aside for their own retirement is used to pay for their child’s international education, and a destination wedding depletes the medical reserve that would have been used in their later years. The mounting financial pressure can be a reason for most parents to set aside their own retirement plans.

Tip: Be realistic when planning your child’s future, don’t go overboard. Live within your means and work towards a balanced lifestyle that suits your income potential.

Retirement is years away.

Nobody enjoys the idea of being old. Most investors who plan their investments struggle to imagine themselves in their golden years. Some believe that they will continue to work even post-retirement. We are unaware of how fragile the human body is or how our functional capacity declines with age. Keep in mind that there are numerous examples of successful people who suffered in their later years and died in poverty. You lack influence if you do not have enough money for retirement. A robust retirement corpus can ensure you are able to retire without being dependent on your loved ones. It serves as a safeguard against burnout or income loss and can help you if an emergency arises that prevents you from working.

Tip: Think of your current lifestyle expenses and calculate the amount you need to set aside as a corpus to maintain the same lifestyle. The value will be sufficient motivation for you to begin saving for retirement.

The right corpus

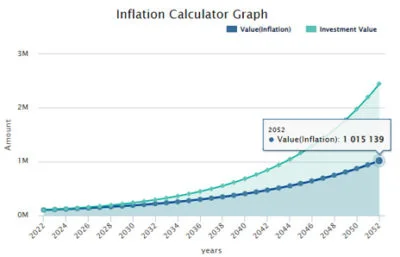

What amount will allow you to live comfortably during your retirement years? When making retirement plans, this is where most people falter. They frequently fall short of their required income because they cannot determine the proper corpus needed. For instance, a monthly expense of Rs. 1,00,000 today is equivalent to approximately Rs. 10,00,000/- 30 years down the line when adjusted for inflation. So even a corpus of Rs. 1 Crore would not suffice to take you through the first year of your retirement. People are frequently dazzled by this unfathomable number, which causes them to put off saving for retirement.

Tip: Inflation and taxes are two big money guzzlers that can eat into your corpus. Plan your investments keeping them in mind and their effects in the future.

Retirement planning cannot be a one-time process that is followed. You must forecast potential influences on the goals you have set for yourself in life, come to terms with how to ensure you achieve your goal with adequate planning, and realize what you need post-retirement. You can make sure that your family’s standard of living is not affected after retirement by making plans and building a sizable retirement corpus.

Be proactive. Think ahead. Plan ahead.

Leave a Comment